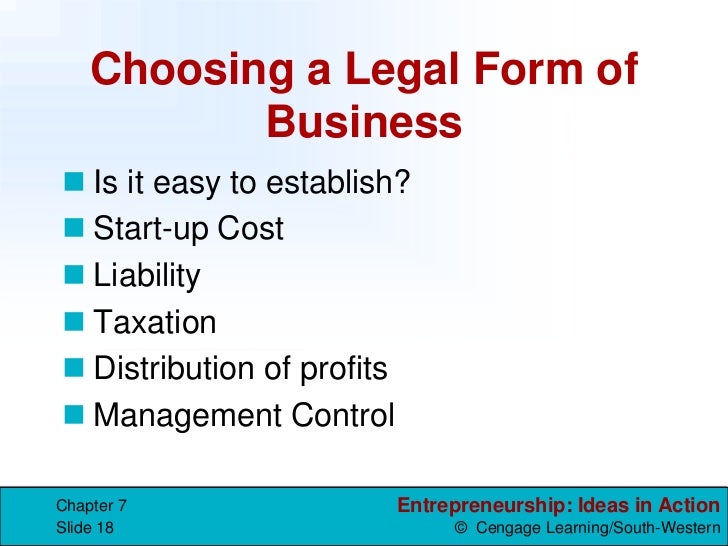

In this unit we explore various forms of ownership (sole proprietorship, partnerships, and corporations) which affects how businesses are taxed, how profits are distributed, and what regulations must be followed. The form of ownership you choose corresponds to the growth, taxation, and future of your company. In this unit we examine some techniques business owners use to analyze profitability. We review the characteristics of successful entrepreneurs, how small businesses impact the economy, and the role of the Small Business Administration in Nepal.

In this unit we explore various forms of ownership (sole proprietorship, partnerships, and corporations) which affects how businesses are taxed, how profits are distributed, and what regulations must be followed. The form of ownership you choose corresponds to the growth, taxation, and future of your company. In this unit we examine some techniques business owners use to analyze profitability. We review the characteristics of successful entrepreneurs, how small businesses impact the economy, and the role of the Small Business Administration in Nepal.

Completing this unit should take you approximately 10 hours.

- Upon successful completion of this unit, you will be able to:

- describe legal forms of businesses, including sole proprietorships, partnerships, corporations, limited-liability corporations, and subchapter S corporations;

- evaluate the appropriateness of the different legal forms of business for various business contexts;

- identify and describe the function of the major components of a business plan;

- analyze the potential of a business to be profitable, when considering legal form of business, tax rates, and break-even analysis; and

- analyze the impact of small business on the economy.

No comments:

Post a Comment